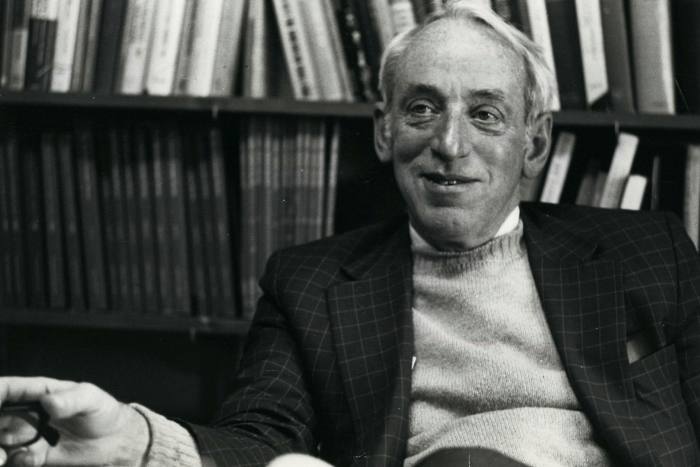

On Monday, David Swensen taught his usual class on investing at his beloved Yale University, despite a long battle with cancer. Two days later, one of the all-time greats of money management finally succumbed, passing away aged 67.

The investment industry has produced more than its fair share of roguish buccaneers and ruthless tycoons, hapless failures and feckless fraudsters. In Swensen — who had run his alma mater’s $31bn endowment since 1985 — it had a rare ascetic, seemingly uninterested in wealth even as he transformed the industry that manages it.

“The really great painters are the ones that change how other people paint, like Picasso. David Swensen changed how everyone who is serious about investing thinks about investing,” says Charles Ellis, who chaired Yale’s endowment between 1997 and 2008.

“The results were wonderful, but were organised to be no surprise,” Ellis adds. “If you watch a great chef prepare in the kitchen, you know the meal is going to be good.”

Swensen never commanded the fame of Warren Buffett, Peter Lynch or Jack Bogle, but among industry insiders he is widely considered in their rank. Ted Seides, a former colleague and author of a book on asset allocators, describes his former boss as the undisputed GOAT — greatest of all time.

“He was constantly coming up with new ideas, new structures, new approaches,” he says. But even his investment success underplays his wider influence, Seides argues. “The (Yale) model itself is so special that almost everyone who worked at Yale endowment ended up being successful. It’s like Goldman Sachs or Tiger Management for the endowment world.”

Like many great careers, Swensen’s had an unlikely beginning. When first approached by Yale University in 1985, he initially assumed it would be for a teaching job — not to lead its $1.3bn endowment. After all, he was just 31 at the time, steeped in economic theory but woefully unfamiliar with investing.

Endowments are pools of money from wealthy donors — mostly alumni of the university — that go towards the cost of staff salaries, paying for scholarships or maintaining school buildings and athletics programmes.

Investing novice

After graduating from Yale with a PhD in economics in 1980, Swensen parlayed a thesis on valuing corporate bonds into a promising career in finance. At Salomon Brothers — the epitome of brash, freewheeling 1980s Wall Street — he helped structure the first ever interest rate swap, between the World Bank and IBM. But he had no experience in the investment industry itself.

Nonetheless, when Yale called he accepted the 80 per cent pay cut and took the job. The career that followed would help reshape the wider investment landscape by transforming the venture capital, hedge funds and private equity industries. Being a novice proved a blessing, unshackling Swensen from conventional practice.

At the core of what became known as the “Yale Model” are principles that Swensen learned from his mentor, Nobel laureate James Tobin.

Tobin had done seminal work on the importance of diversified investing — building on the “modern portfolio theory” of fellow Nobel laureate Harry Markowitz — a principle which Swensen then married with a vastly longer investment time horizon than was normal for endowments.

The model stipulates far greater exposure to more volatile — but in the long run higher-returning — stocks, spread across public and private markets to minimise risks. For Swensen and Yale, that meant putting money into what were nascent hedge fund, private equity and venture capital industries, as well as real estate and eventually even obscure niches such as lumber.

Established practice now, this approach to asset allocation was sensational at the time. The Yale Model arrived when most universities hewed to a then standard stocks-and-bond portfolio — often with an unimaginative 60:40 split — and no endowment was considered worth watching in the investment world.

Swensen unleashed a revolution, with endowment money eventually gushing into “alternative” investments that had been the preserve of wealthy heirs and rich tycoons, transforming the hedge fund, venture capital and private equity industries in the process.

The results were stellar. The Yale Investments Office managed $31.2bn as of June 2020 — averaging annual returns of 12.4 per cent over the past three decades — and contributes more than a third of the university’s budget.

While Swensen was not the sole architect of this model, he is credited with perfecting it. He also popularised it, as an army of acolytes replicated his approach in funds and endowments across the US.

Swensen had “an uncanny ability to identify investment talent”, said Paula Volent, who has run the $1.8bn endowment for Bowdoin College in Maine for the past two decades and worked in Yale’s investment office earlier in her career. “He was instrumental in changing many of our lives.”

Hands of poker

His passion for teaching was not confined to the lecture theatre. After long investment meetings, he’d play poker deep into the night with his investment office staffers, not for much money, but for the game itself. Between hands, they’d chew over investment issues that had come up that day.

“He understood the value of optionality intuitively and was also not afraid to play very aggressively when he thought the odds favoured him,” says Robert Wallace, who Swensen hired as an intern when he was a Yale undergraduate in his mid-30s, studying economics after a career in professional ballet.

Wallace worked under Swensen for five years, before running a family office and then moving to manage Stanford University’s $29bn endowment. But he still remembers those poker nights fondly. “I think I learned as much from David during our conversations over the poker table as I did in the formal meetings,” he says.

For those not at the poker table, Swensen’s 2000 magnum opus, Pioneering Portfolio Management, allowed them to absorb his investment philosophy.

A wrong fit for Wall Street

At Partners Capital, a $40bn investment group that manages money on behalf of endowments and charities, the book is mandatory reading for new hires, and its founder Stan Miranda paid tribute to Swensen’s influence.

The book “was a masterpiece of investment literature”, he wrote in a memo to staff. “(It is) a powerful blueprint for long-term institutional portfolio management.”

Swensen was born in River Falls, Wisconsin, in 1954. His father was a chemistry professor at the University of Wisconsin, and his mother a Lutheran minister, who helped settle more than 100 foreign refugees there. His background perhaps explains why he never took to investment banking.

“I liked the competitive aspects of Wall Street, but — and I’m not making a value judgment here — it wasn’t the right place for me because the end result is that people are trying to make lots of money for themselves,” Swensen once told Yale’s alumni magazine. “That just doesn’t suit me.”

He was still richly rewarded: his reported pay of $4.7m in 2017 made him Yale’s best-paid employee. But there is no doubt that his investment pedigree could have made him a fortune. If he had run a hedge fund the size of Yale’s endowment — and with its returns — Swensen would probably have been a multi-billionaire.

Friends and colleagues point to his devotion to Yale athletics, his ferocious competitiveness when it came to the endowment’s “Stock Jocks” softball team and his routine acts of kindness. When Tobin’s legs began to fail him, Swensen started shovelling the snow off his mentor’s doorstep every day through the cold New Haven winters, Ellis recalls.

The question now is who might follow Swensen — or whether anyone truly can. Miranda speculated that the Yale Model will become “like artwork, it only becomes more highly valued after the artist passes”.

The most natural successor is Dean Takahashi, Swensen’s longtime former lieutenant, who now runs a climate change initiative at Yale. But Ellis notes that the challenges facing any investment officer are now far greater than they were when Swensen picked up the reins in 1985, given the lofty valuation of stocks, the record low level of interest rates, and that the once-pioneering Yale Model has been copied across the world — with variable success.

“I would not want to be the second person in David’s job,” Ellis says. It is a sentiment many of his friends and colleagues echo. “David can have a successor, but not a replacement,” says Wallace. “He was unique.”

Swensen is survived by his wife, Meghan McMahon, three children and two step children.

https://ift.tt/3vRgtKh

Business

Bagikan Berita Ini

0 Response to "David Swensen, the Yale pioneer who reshaped investing - Financial Times"

Post a Comment