Here are five things you must know for Friday, May 28:

1. -- Stock Futures Point to a Fourth Month of Gains

Stock futures were higher Friday as the S&P 500 looked to close out May with its fourth straight month of gains.

Contracts linked to the Dow Jones Industrial Average rose 156 points, S&P 500 futures were up 14 points and Nasdaq futures gained 44 points.

Wall Street has been powered higher by signs of a solid U.S. economic recovery from the COVID-19 pandemic and a Federal Reserve that has provided extraordinary support.

Economic data on Thursday indicated the employment picture in the U.S. was improving as jobless claims fell to a fresh pandemic low.

The data, as well as a report that said President Joe Biden was set to unveil a budget of $6 trillion in the coming fiscal year, boosted equities, particularly those that would benefit most from increased federal spending.

The Dow Jones Industrial Average rose 141 points, or 0.41%, to close at 34,464 and the S&P 500 gained 0.12%. The Nasdaq ticked down 0.01%.

Investors will be monitoring personal spending data on Friday for signs of inflation as the economy rebounds.

2. -- Friday's Calendar: PCE Index and Consumer Sentiment

The U.S. economic calendar Friday includes Personal Income and Outlays for April, including the Federal Reserve's preferred inflation gauge, the Personal Consumption and Expenditures Index, at 8:30 a.m. ET.

The calendar also includes International Trade in Goods (Advance) for April at 8:30 a.m. and Consumer Sentiment for May at 10 a.m.

Earnings reports are expected Friday from Big Lots (BIG) - Get Report and Hibbett Sports (HIBB) - Get Report.

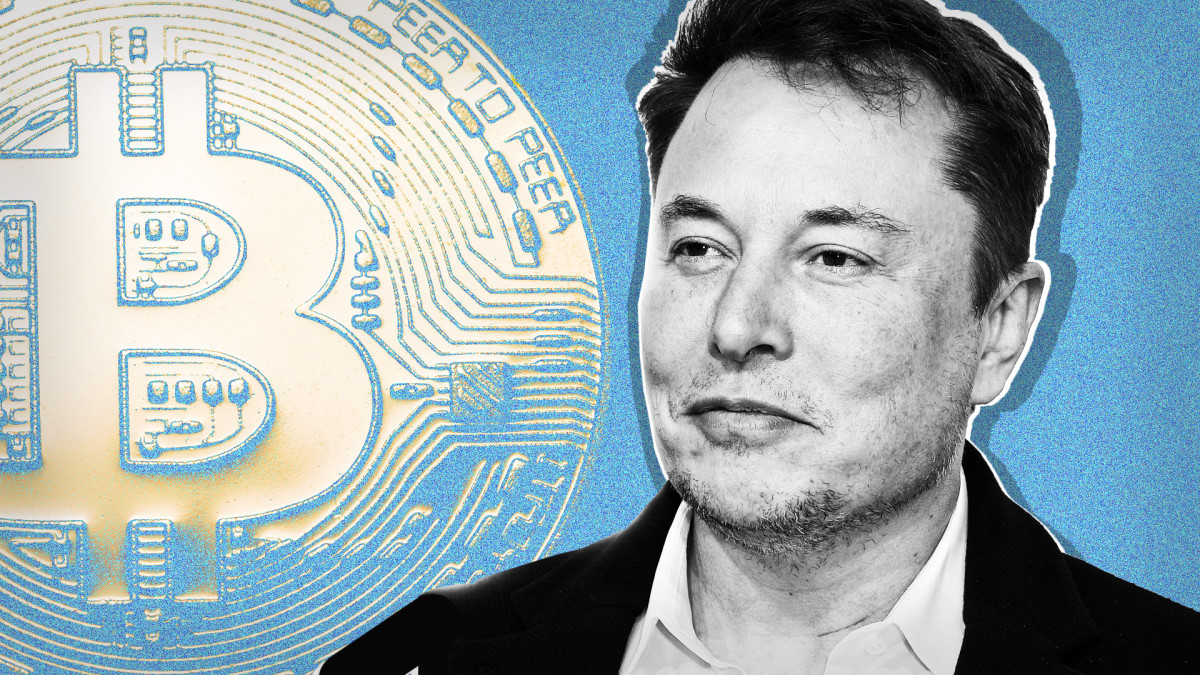

3. -- Cathie Wood Blames Elon Musk and 'ESG Movement' for Bitcoin Drop

Bitcoin prices were sliding early Friday to below $36,000, down nearly 44% from the cryptocurrency's record high in mid-April.

Cathie Wood, the founder of ARK Investment Management, said Tesla (TSLA) - Get Report CEO Elon Musk and the “ESG movement” were responsible for the recent drop in digital currencies.

“It was precipitated by the ESG [environmental, social and governance] movement and this notion, which was exacerbated by Elon Musk, that there are some real environmental problems with the mining of bitcoin. A lot of institutional buying went on pause,” Wood said at the Consensus 2021 conference organized by CoinDesk.

Wood said she remains confident in the future of Bitcoin, which she described as the first rules-based “global monetary system in the world,” CoinDesk reported.

She also told the conference that Musk will prove positive for Bitcoin in the long term, improving its environmental profile.

On Friday, Bank of Japan Gov. Haruhiko Kuroda warned about Bitcoin’s volatility and criticized the token, saying it's "barely used as a means of settlement.”

4. -- Costco Warns of Rising Costs

Shares of Costco (COST) - Get Report were slipping in premarket trading after the warehouse retailer reported a 22% jump in revenue in its fiscal third quarter but also warned of rising costs.

Costco Chief Financial Officer Richard Galanti told analysts and investors on the company's earnings call that the retailer was seeing higher costs for products such as fresh meats, imported cheeses and paper goods. The "inflationary pressures" cited by Galanti also included higher labor costs.

"Inflationary factors abound," Galanti said on the conference call. Costco has been working to control cost increases and supply chain delays by adjusting ordering and purchasing inventory early, the financial chief said.

The stock was down 0.65% to $385 in premarket trading Friday.

Jim Cramer and the Action Alerts PLUS team, which holds Costco in its portfolio, praised the company's earnings report.

"We continue to believe Costco should be appreciated as one of the most consistent and defensive names in all of retail," they said.

5. -- Salesforce Boosts Fiscal-Year Outlook

Salesforce.com (CRM) - Get Report was rising nearly 5% in premarket trading after the maker of cloud-based customer relationship software posted first-quarter earnings and revenue that topped forecasts and also raised its outlook for the fiscal year.

Salesforce said adjusted earnings for the year would be $3.79 to $3.81 a share, higher than Wall Street estimates. The company said it expects annual revenue of $2.59 billion to $26 billion vs. expectations of $25.75 billion.

Analysts at Jefferies, which rate the stock a buy with a price target of $300, said Salesforce “remains top front office pick as pipelines continue to improve.”

Jim Cramer and the Action Alerts PLUS team, which holds Salesforce in its portfolio, said that while Salesforce may have been a "COVID winner," they believe the company "to be more so the beneficiary of an acceleration - rather than a temporary surge in demand - of the 'fourth industrial revolution,' and that the business gained over the past year will prove stickier than the recent price action would indicate."

Shares of Salesforce were rising 4.87% to $236.82.

Article From & Read More ( Bitcoin, Cathie Wood, Elon Musk, Salesforce, Costco: 5 Things You Must Know - TheStreet )https://ift.tt/3vBeI4k

Business

Bagikan Berita Ini

0 Response to "Bitcoin, Cathie Wood, Elon Musk, Salesforce, Costco: 5 Things You Must Know - TheStreet"

Post a Comment